Achieving Financial Stability With Strategic Planning 3511030659

Achieving financial stability requires a methodical approach to strategic planning. Individuals must first establish clear financial goals and assess their current financial standing. This foundational analysis is critical for crafting a comprehensive financial plan. Moreover, continuous monitoring and adjustments to this plan can enhance overall effectiveness. However, the intricacies of this process often reveal unexpected challenges and opportunities that merit further exploration. The next steps could be pivotal in shaping one’s financial future.

Setting Clear Financial Goals

Setting clear financial goals is a fundamental step in the quest for financial stability. Individuals should delineate short-term goals, such as saving for an emergency fund, alongside long-term goals, like retirement planning.

This dual approach fosters a structured financial roadmap, allowing for immediate achievements while aligning with broader aspirations. Strategic goal-setting empowers individuals, enhancing their ability to attain freedom and control over their financial futures.

Assessing Your Current Financial Position

An accurate assessment of one’s current financial position serves as the foundation for effective financial planning.

Conducting a thorough budget analysis enables individuals to identify spending patterns and potential savings.

Additionally, asset evaluation allows for the determination of net worth and investment viability.

Together, these assessments create a clear financial picture, empowering individuals to make informed decisions that enhance their path to financial freedom.

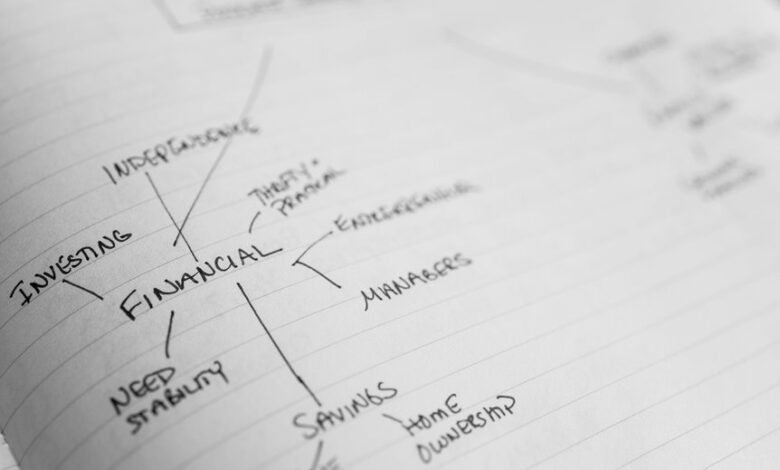

Developing a Comprehensive Financial Plan

While many individuals recognize the importance of financial planning, developing a comprehensive financial plan requires a strategic approach that encompasses various elements of personal finance.

Effective budget allocation ensures resources are utilized optimally, while investment diversification minimizes risks and enhances growth potential.

Monitoring and Adjusting Your Strategy

Creating a comprehensive financial plan is only the beginning of the journey toward financial stability; ongoing monitoring and adjustment are vital for sustained success.

By consistently tracking progress and evaluating performance, individuals can identify deviations from their strategic goals.

Adjustments based on these insights allow for a more adaptable approach, ensuring financial strategies align with changing circumstances, ultimately fostering greater freedom and stability.

Conclusion

In conclusion, the journey toward financial stability hinges on meticulous planning and continuous evaluation. As individuals set their sights on their goals, the tension between current limitations and future aspirations looms large. Will they uncover hidden savings and unlock investment potential, or will they falter in the face of unforeseen challenges? By maintaining a vigilant approach to monitoring and adjusting their strategies, they stand poised at a pivotal crossroads, ready to embrace the promise of lasting financial independence.