Maximizing ROI Through Effective Financial Management 3206590342

Maximizing ROI through effective financial management requires a methodical approach. Organizations must prioritize strategic financial planning, employing diverse budgeting techniques to ensure resources are allocated efficiently. A thorough analysis of financial performance is critical for informed decision-making. Additionally, implementing stringent cost control measures can uncover hidden inefficiencies. Understanding these components is essential for fostering sustainable growth and enhancing profitability. The implications of this strategy warrant further exploration.

The Importance of Strategic Financial Planning

Strategic financial planning serves as a cornerstone for organizational success, guiding decision-makers in resource allocation and risk management.

It involves rigorous risk assessment and financial forecasting, enabling organizations to anticipate challenges and capitalize on opportunities.

Budgeting Techniques for Optimal Resource Allocation

Effective budgeting techniques are essential for organizations aiming to optimize resource allocation and enhance financial performance.

Zero-based budgeting empowers teams to justify expenses from scratch, aligning them with strategic goals.

Complementing this, flexible forecasting allows for adaptive financial planning, accommodating dynamic market conditions.

Together, these methods foster an environment of accountability and resource efficiency, ultimately driving improved returns on investment.

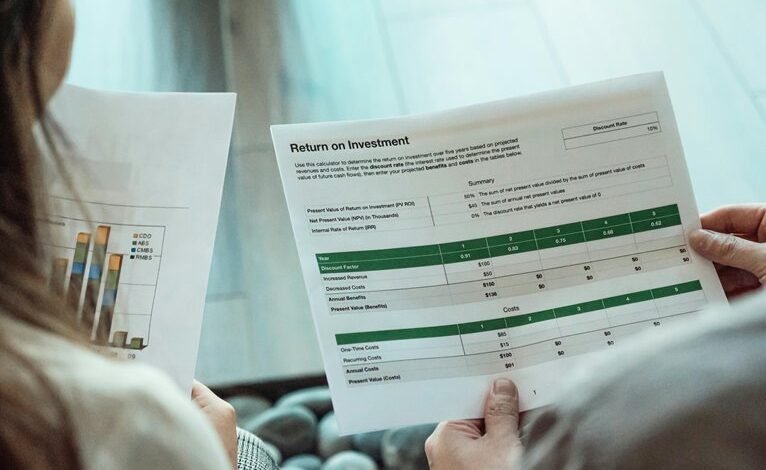

Analyzing Financial Performance for Informed Decision-Making

A comprehensive analysis of financial performance is crucial for organizations seeking to make informed decisions that drive growth and sustainability.

By leveraging financial ratios and performance metrics, companies can evaluate their operational efficiency, profitability, and liquidity.

This strategic approach enables stakeholders to identify strengths and weaknesses, fostering a data-driven culture that empowers organizations to align their resources effectively and enhance overall performance.

Implementing Effective Cost Control Measures

Cost control measures serve as essential tools for organizations aiming to optimize their financial resources and improve profitability.

By implementing cost-saving strategies and robust expense tracking systems, companies can systematically identify inefficiencies and reduce unnecessary expenditures.

This strategic approach not only enhances financial performance but also empowers organizations to allocate resources more effectively, ultimately leading to greater operational freedom and increased return on investment.

Conclusion

In conclusion, the journey toward maximizing ROI through effective financial management is fraught with challenges yet rich with potential. By strategically aligning financial planning, employing innovative budgeting techniques, and rigorously analyzing performance, organizations can unlock hidden efficiencies. However, the true test lies in their ability to implement cost control measures without stifling growth. As they navigate this intricate landscape, the question remains: will they seize the opportunity for sustainable success, or falter in the face of complexity?